Chromebooks have evolved far beyond their humble beginnings as affordable laptops for students. These cloud-based devices are now reshaping how people work, learn, and connect across diverse sectors. In 2025, rising demand from schools, budget-conscious businesses, and users who value speed and simplicity has fueled remarkable growth in the chromebook market share.

With faster updates, improved performance, and premium hardware options, Chromebooks are firmly established in education and entry-level business segments while beginning to compete in the high-end category with models like the Chromebook Plus.

This comprehensive analysis explores the latest data, regional adoption patterns, vendor performance, and technological upgrades driving both Chromebook and chrome os market share momentum.

Global Chromebook Market Performance

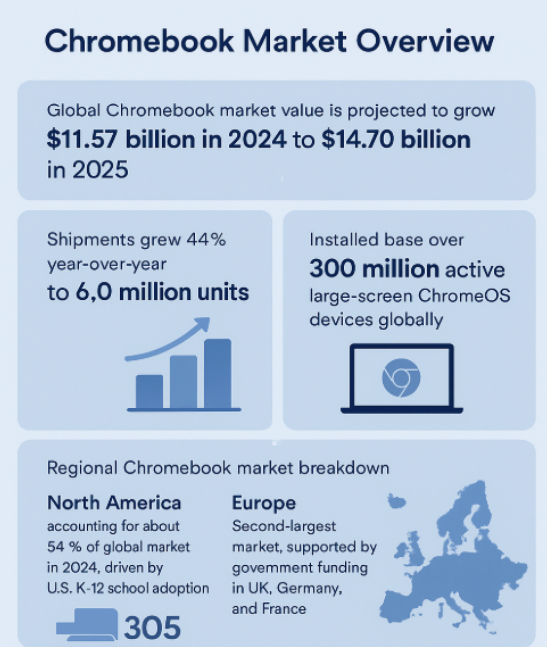

The global Chromebook market demonstrates robust expansion with a projected market value of USD 14.7 billion in 2025, rising to USD 42.9 billion by 2034, representing a compound annual growth rate of 12.62%. This growth trajectory reflects the increasing adoption of cloud-centric computing solutions across multiple sectors.

Global shipments reached 22.11 million units in 2025 and are projected to rise to 26.72 million units by 2030, advancing at a 3.86% CAGR.

The market is normalizing after the pandemic-era surge, yet consistent device refresh cycles, expanding corporate pilots, and widening geographic penetration maintain steady upward momentum. For consumers wondering about the value proposition, understanding whether Chromebooks are worth it has become increasingly relevant as these devices mature.

The Chromebook vendor landscape shows dynamic competition among established technology companies. In the first half of 2025, Lenovo led the global market with 3.5 million units shipped, marking a 27% year-on-year growth, largely bolstered by its strong role in Japan’s GIGA School Program.

Currently, 11 active brands manufacture Chromebooks as of 2025: Acer, ASUS, Dell, HP, Lenovo, Samsung, LG, NEC, Fujitsu, Poin2 Lab, and Sharp. The competition has intensified with regional manufacturers launching budget-friendly options while established players focus on AI capabilities, battery life, and processing power to retain market positions.

Chrome OS Market Share Analysis

Chrome OS maintains a stable presence in the desktop operating system landscape. Globally, Chrome OS holds approximately 1.86% of the desktop OS market share as of March 2025. However, regional variations show more significant adoption, particularly in North America where Chrome OS commands 8.44% of the US desktop market.

The chrome os market share has grown substantially from its initial launch. When combined with traditional Linux distributions, the “Linux family” (including Chrome OS) reaches 7.74% market presence in the US desktop market, demonstrating the growing influence of Linux-derived systems.

Regional Chromebook Market Share Patterns

Regional adoption varies significantly, reflecting different educational policies, economic conditions, and technological infrastructure capabilities. The question of are Chromebooks worth it receives different answers depending on regional needs and infrastructure development.

North America: Maintains the largest share at 52.4% of global Chromebook usage, primarily driven by US K-12 educational demand. In 2025, 93% of US districts intend to purchase Chromebooks, up from 84% in 2023, with 68% now drawing funds from local or state revenues rather than federal allocations.

Asia-Pacific: Represents the fastest-growing region with a CAGR of 4.70%, fueled by digital education funding initiatives in countries like India, China, Japan, and South Korea. Government-led digitalization programs and increasing student enrollments drive adoption.

Europe: Holds approximately 32% market share with strong adoption in the UK, Germany, and France due to government backing for educational technology integration.

Latin America & Africa: Show emerging growth through government-led educational technology initiatives, though infrastructure challenges remain in some regions.

ChromeOS Enhancements and Hardware Upgrades

ChromeOS continues evolving with regular updates occurring every 4-6 weeks, offering continuous security, performance, and user interface improvements. Recent significant updates have transformed the platform’s capabilities, making the Google Chromebook Plus and ChromeOS ecosystem more compelling for diverse user needs.

ChromeOS 134 introduced a major shift by replacing Google Assistant with the Gemini chatbot, marking Google’s move toward text-based AI interaction. ChromeOS 130 brought productivity features including Quick Insert, Focus Mode, and Welcome Recap for improved content summarization.

Accessibility improvements include new controls via facial and head gestures on supported hardware, with rollouts continuing through 2025. AI integration has become core to the operating system, with Chromebook Plus models shipping with on-device and browser-based AI via Gemini.

User Demographics and Sector Penetration

Market Segment Analysis 2025

| Segment | Market Status | Growth Trends |

|---|---|---|

| Education | Dominant use case – 60.1% market share | K-12 spending and government programs driving growth globally |

| Enterprise | Expanding beyond thin-client roles | 8.20% CAGR – fastest growing segment with AI/cloud integration |

| Consumer | Popular secondary device for casual use | Premium consumers adopting Chromebook Plus for AI-driven tasks |

| Premium | High-end Chromebook Plus adoption | Enthusiasts choosing models like Samsung Galaxy Chromebook Plus |

Chromebook Plus vs Standard Chromebook Comparison

The introduction of Chromebook Plus models has created a distinct tier in the market, offering enhanced capabilities for users requiring more performance and AI-powered features.

| Feature | Chromebook Plus | Standard Chromebook |

|---|---|---|

| Processor & RAM | Intel 12th/13th-gen or ARM Tensor; ≥8 GB RAM | Moderate processors; 4-8 GB RAM |

| AI Tools | Gemini-powered AI: live translate, Magic Editor, Recorder | Basic Gemini chatbot support |

| Accessibility | Full AI-driven control, Quick Insert button | Core features: Focus Mode, Welcome Recap |

| Price Range | USD $349-699, flagship specifications | USD $200-400, value-focused |

Future Outlook for Chromebook and Chrome OS Markets

The Chromebook ecosystem is rapidly evolving into a dual-core offering: standard devices for mass education and casual use, and Chromebook Plus as premium AI-enhanced laptops. For consumers evaluating their computing needs, the question of whether Chromebooks are worth it increasingly depends on specific use cases and feature requirements.

As Gemini becomes more deeply embedded, AI-first features will redefine user experiences from classroom to boardroom. Global rollout of hardware upgrades, accessibility innovations, and cloud integration suggests Chromebooks are moving beyond budget niches toward central roles in future computing.

The challenge ahead lies in balancing cloud dependency with offline capability, broad enterprise app compatibility, and sustained upgrade cycles that maintain ChromeOS relevance. Supply-side innovation supports continued growth through tighter ChromeOS-Android convergence, on-device generative AI, and advanced ARM chipsets reshaping value propositions.

What is the current global market value of Chromebooks?

The global Chromebook market is valued at USD 14.7 billion in 2025 and is projected to reach USD 42.9 billion by 2034, growing at a CAGR of 12.62%.

Which companies lead the Chromebook market?

Lenovo currently leads with 3.5 million units shipped in the first half of 2025, followed by HP, Acer, Dell, and ASUS. These five vendors dominate the competitive landscape.

What is Chrome OS market share compared to other operating systems?

Globally, Chrome OS holds approximately 1.86% of desktop OS market share. In the United States, Chrome OS commands a stronger 8.44% market share, significantly higher than the global average.

Which regions show the strongest Chromebook adoption?

North America leads with 52.4% of global market share, while Asia-Pacific shows the fastest growth at 4.70% CAGR. Europe holds approximately 32% market share with strong government support for educational technology.

What sectors drive Chromebook demand most significantly?

Education remains the dominant sector with 60.1% market share, though enterprise adoption is growing fastest at 8.20% CAGR as businesses embrace cloud-based computing solutions.

Sources

- Custom Market Insights. (2025). “Global Chromebook Market Size, Trends, Share 2025-2034.” https://www.custommarketinsights.com/report/chromebook-market/

- Mordor Intelligence. (2024). “Chromebook Market Size, Trends, Share Analysis & Research Report, 2030.” https://www.mordorintelligence.com/industry-reports/chromebook-market

- Market Data Forecast. (2025). “Chromebook Market Size, Share, Trends & Growth Report, 2033.” https://www.marketdataforecast.com/market-reports/chromebook-market

- Canalys. (2025). “Global tablet shipments up for sixth quarter, Chromebook demand rebounded in Q2 2025.” https://www.canalys.com/newsroom/global-tablet-market-q2-2025

- Wikipedia. (2025). “Usage share of operating systems.” https://en.wikipedia.org/wiki/Usage_share_of_operating_systems