Good news first: you no longer need to beg a traditional bank for a six-month underwriting marathon just to top up inventory or bridge a slow receivables cycle. A merchant cash advance (MCA) can land in your account in a day or two and flex with your card sales.

Below, we’ll look at why MCAs slot neatly into the playbooks of Chromebook resellers, device-as-a-service shops, and edtech SaaS founders and then walk through five funding partners that consistently show up on every credible merchant cash advance company list.

Why Merchant Cash Advances Fit Digital Hardware Players?

Tech hardware and edtech startups ride some of the choppiest cash-flow waves around. A district-wide Chromebook tender can drain working capital overnight; a delayed component shipment can push revenue into the next quarter.

An MCA ties repayment to your actual credit- and debit-card receipts, allowing payback to shrink during a quiet stretch and grow when sales spike. That elasticity is exactly what small tech entrepreneurs tell us they need when unit demand is lumpy or seasonal.

The model also favors new ventures with thin credit files. Instead of fixating on FICO, most merchant cash advance providers study your last three to six months of revenue.

If your Stripe or Square statements appear robust, you have a strong chance, even if your personal score still bears the scars of bootstrapping.

Cash-Flow Swings in Tech Retail and EdTech

Let’s make it concrete. Say you wholesale 400 Chromebooks to a charter school network in August. You won’t collect the final payment until November, yet you must reorder in September to prepare for Black Friday.

A $120,000 business cash advance no credit check could front that purchase. During September and October, you remit a fixed percentage of daily card sales from accessory bundles.

When the November payment hits, the advance shrinks rapidly, and you avoid a giant fixed installment that would have mauled cash flow in October. That’s the beauty tech sellers keep coming back for.

How an MCA Works in Plain English?

An MCA is not a loan; it’s the purchase of future receivables. The funder wires you a lump sum – let’s use $120,000 again, for example, for restaurant equipment financing for startups – and tacks on a factor rate, maybe 1.25. That means you’ll eventually send back 150,000.

Instead of invoicing you monthly, the funder stitches into your payment processor and automatically sweeps, say, 12 percent of your daily card revenue until the $150,000 is satisfied.

If a slow month brings in only 40,000 in card sales, your remittance is $4,800; when December rings up $200,000, you send $24,000. No late fees, no collateral liens on your servers.

The Cost-vs-Speed Trade-Off

Here’s the honest part. MCA pricing skews higher than a bank term-loan APR, often the equivalent of 25-45 percent annualized if you pay it off quickly. You’re buying speed and flexibility, not the cheapest capital on Earth.

For many founders, that’s a fair exchange, especially if a missed bulk-buy discount or lost client would cost even more.

Still, compare offers side by side; small tweaks in factor rate or holdback percentage move the total cost by thousands.

5 Best Picks for 2026

We sifted the field to find five options that consistently rank among the top MCA lenders for tech-centric small businesses. Each combines quick underwriting with a track record of transparent terms.

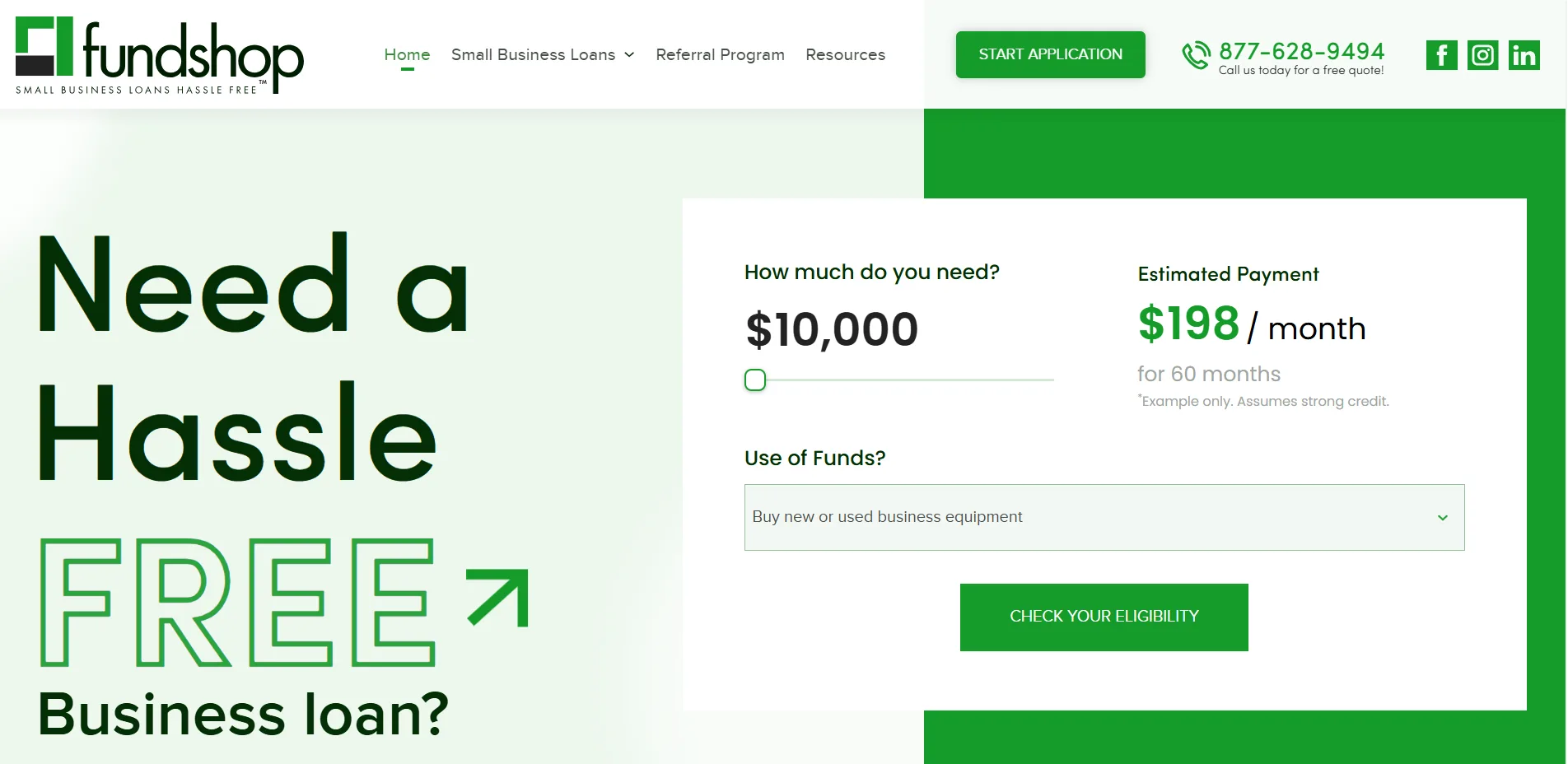

Fundshop

Source: Fundshop

Fundshop behaves more like a data company than a lender. Their algorithm grabs your recent revenue and spits out an offer, often within hours. Tech retailers like the no-collateral stance and the ability to choose daily or weekly splits.

Funding can hit in as little as 24 hours, handy when you’re racing a component price hike. Factor rates start near $1.15 for stronger files, putting Fundshop in the front row of the best merchant cash advance companies on cost transparency alone.

Credibly

Source: Credibly

Credibly looks past a thin credit score and focuses on revenue trends – great if you’ve only been shipping devices for 12 months, but sales are blasting upward. Advances range from $5,000 to $400,000 with terms up to 18 months.

Many founders praise their quick-to-respond account managers, though communication can vary. Daily or weekly remittance prevents a cash crunch at the end of the month, and early payoff discounts enhance the benefits.

Credibly routinely lands on any list of top merchant cash advance companies because of its blend of speed and mid-range pricing.

Lendio

Source: Lendio

Lendio is a marketplace, not a direct funder, pairing you with more than seventy-five merchant cash advance companies. That wide lens is priceless if your numbers sit on the border between approval and decline.

Advances can stretch to 36 months – longer than most direct MCA shops – so your daily split can remain small.

Tech founders often walk away with competing offers within three days, making it easier to pinpoint the best merchant cash advance for their exact cash-flow pattern.

Rapid Finance

Source: Rapid Finance

Rapid Finance has funded over a billion dollars since 2005 and leans on fifteen-plus years of MCA data. Their underwriting feels almost frictionless: upload three months of statements and a driver’s license, and you can receive a term sheet the same afternoon.

Limitations climb above $500,000, which helps if you need to buy servers or LFP batteries in bulk. Edtech platforms like the ability to ladder multiple advances over time without reopening new files, a route few MCA loan companies allow.

Fora Financial

Source: Fora Financial

Fora Financial’s calling card is high maximums, occasionally north of $1.5 million, and generous early payoff rebates. If you expect a big invoice payment next quarter, that discount can slice the factor rate meaningfully.

Fora welcomes businesses only six months old, provided you clock at least 12,000 in monthly sales. Hardware importers also rave about the option to direct-deposit a chunk of the advance to overseas suppliers, dodging wire delays.

Choosing Among Merchant Cash Advance Providers

Plenty of firms will wire you cash; only a handful will do it on terms that won’t haunt you six months later. Compare factor rate, holdback percentage, estimated payback period, and any origination fees.

Ask whether the funder will report to business credit bureaus – helpful if you want to graduate to cheaper financing later.

And insist on a clear reconciliation statement every week; you’d be shocked how many merchant cash advance providers still send vague PDFs.

Key Metrics to Compare

Before you commit to any advance, pause long enough to weigh the numbers side by side. The five metrics below give you a quick-scan way to see which offer is genuinely affordable and which one only looks shiny at first glance.

- Effective APR. Convert the factor rate and projected duration into an annualized figure so you’re not guessing.

- Daily cash flow impact. Multiply the holdback rate by your slowest-month sales, not your best month.

- Renewal policy. Some merchant cash advance companies list and automatically roll you into a new advance when the current one is 50 percent repaid; great for continuity, terrible if you can’t hit pause.

- Prepayment terms. A 5 percent discount for paying off early can erase a chunk of the cost.

- Customer support. When your processor freezes payouts, you’ll want a human on the phone, not a chatbot stuck on level one.

When an MCA Makes Sense and When It Doesn’t?

Thumb rule: use an MCA to generate new cash, not to patch a permanent leak. Stocking the new Chromebook Plus line ahead of corporate training season? Good call. Funding payroll every single month? Probably a sign you need a deeper fix or a line of credit.

According to Emergen Research, most of the firms that used revenue-based financing did so to seize a growth opportunity they otherwise would have missed.

That’s a green-flag reason. Using an MCA to cover routine overhead ranked among the top predictors of refinancing stress twelve months out.

Alternatives to Keep on Your Radar

Even the best merchant cash advance doesn’t live in a vacuum. Hardware resellers with strong receivables might explore invoice factoring at sub-20 percent APR. Edtech SaaS shops with recurring ACH contracts often qualify for subscription-revenue financing at even lower rates.

Equipment leasing can preserve cash for marketing. Still, none of these rivals wins on raw speed; they usually take a week or more to fund. Keep an MCA in your toolbox for moments when twenty-four hours really matter.

Quick Checklist Before You Apply

A little prep work will speed up underwriting and help you avoid last-minute scrambles. Knock out the items below, and you’ll shave hours, sometimes days, off the funding timeline.

- Reconcile the last six months of card statements; funders will ask.

- Draft a use-of-funds sheet – bulk purchase, trade show booth, or ad campaign. Clarity speeds approval.

- Freeze discretionary outflows for 30 days; you’ll need the wiggle room while payback ramps up.

- Shop at least three offers. A merchant cash advance company’s listing on an aggregator site can help narrow the field quickly.

- Map your seasonality so you don’t panic the first time remittances look large in a high-sales week.

Complete those steps, and you’ll look organized, professional, and low-risk to any funder. That often translates into better terms and, just as important, a smoother borrower experience.

Final Thoughts

Merchant cash advances serve as both beneficial and detrimental tools. In the hands of a focused Chromebook distributor or ambitious edtech founder, they unlock inventory buys, marketing bursts, and bridge capital in record time.

Misused, they chew through margins. Start by vetting several leading cash advance companies, weigh the true cost, and line up a clear ROI on every borrowed dollar. If you can flip $50,000 of advance into $80,000 of margin within ninety days, the math speaks for itself.

IDC’s Personal Computing Device Tracker shows that overall personal computing device shipments (including PCs and tablets) grew modestly in 2025; for example, total worldwide devices, including Chromebooks, were up about 4.1% year‑over‑year in Q3 2025.

That kind of surge rewards businesses nimble enough to load up on stock the moment demand turns. An MCA – obtained from top cash advance providers – can provide that nimbleness when traditional lenders move too slow.

Just remember: speed is an advantage only if you outrun the cost. Choose wisely from the list of merchant cash advance companies in the USA, repay aggressively, and keep your balance sheet light enough to seize the next big tech wave.